16 March 2005

Color Comparison Pic

I found a more up-to-date aerial photo on which I could overlay the ballpark/retail concept. Yes, that is Mt. Davis in the background, hideous as it is.

The DC Deal and how it affects Oakland

In a previous post I mentioned how I thought the Washington Nationals new ballpark deal would provide an example for how a ballpark would be built in the new, post-boom era. The combination of community redevelopment and ballpark are being pitched by the proponents, and it is no coincidence that the public financing deal was put together by former Oakland City Manager (and A's stadium proponent) Robert Bobb.

DC's CFO, Natwar Gandhi, just completed his review of 8 alternative "private" funding proposals. Of the 8, only 2 were approved by Gandhi. One involves a large loan from Deutsche Bank in exchange for some portion of ballpark-related revenues, and the other creates revenues to fund the project from the creation of a parking district around the ballpark. At first I didn't think the latter option would be feasible in Oakland, but the more I think about it, it's more of a possibility. In short, it's a way of diverting funds as parking revenue would pay off the stadium instead of going to the team. Whether that becomes a popular proposal is another story.

Washington Post columnist Steven Pearlstein went on to analyze Gandhi's analysis, posing a question that these days does not have a clear-cut answer: What defines "public" and "private" funding? Pearlstein also just finished a web Q&A session which illuminates among other things, his own opinion (ambivalent? balanced? He does support it, warts and all) on the DC ballpark. I got there in time to pose a question:

Both are good reads if you're interested in such matters.

DC's CFO, Natwar Gandhi, just completed his review of 8 alternative "private" funding proposals. Of the 8, only 2 were approved by Gandhi. One involves a large loan from Deutsche Bank in exchange for some portion of ballpark-related revenues, and the other creates revenues to fund the project from the creation of a parking district around the ballpark. At first I didn't think the latter option would be feasible in Oakland, but the more I think about it, it's more of a possibility. In short, it's a way of diverting funds as parking revenue would pay off the stadium instead of going to the team. Whether that becomes a popular proposal is another story.

Washington Post columnist Steven Pearlstein went on to analyze Gandhi's analysis, posing a question that these days does not have a clear-cut answer: What defines "public" and "private" funding? Pearlstein also just finished a web Q&A session which illuminates among other things, his own opinion (ambivalent? balanced? He does support it, warts and all) on the DC ballpark. I got there in time to pose a question:

San Jose, Calif.: What happens if there are cost overruns in the ballpark construction phase? Are there agreements (guarantees) in place that would shelter the DC taxpayer?

Steven Pearlstein: No, that is one of the big risks that council members were hoping to mitigate. Some of the developer proposals would have done that, but, as I say, at too high a cost. Remember,the question isn't whether you want to minimize risk, but what people will charge you for the privilege. There is no free lunch.

Both are good reads if you're interested in such matters.

Status and Speculation

Before I proceed with today's news, it is important to point out a few facts since I've had a few questions on this. That way no one starts running wild with the information posted here.

Disclaimer over.

- There is no ballpark deal imminent. While Wolff has been bringing in consultants to explore possibilities (it is his job currently as VP of venue development), it is important to understand that no proposal has yet been put in front of any public entities. It will probably take 6 months to do a detailed economic study, 3-6 months for it to be reviewed by local politicos, and 3 more to complete a detailed environmental impact report. Then construction would take another 30-36 months. That doesn't include the possibility of a referendum, which would be required if public bonds were to be issued. So no one should expect to hear any piles being driven into the ground for a while. As news comes in, I will post it and provide analysis.

- The Wolff/Fisher group has not yet been fully approved to take over ownership. But it does appear that the approval is being fast-tracked, so it is entirely possible the change will occur before opening day. It is also possible that Steve Schott and Billy Beane may end up as minority partners.

- Any development plans or drawings I put up here are nothing but conjecture at this point. I am not an insider, so I don't have the pulse of Wolff and his crew. I do have a fairly good understanding of how stadium projects get funded, so I figure I can reasonably articulate much of the inner workings.

- I personally am trying to stay away from the advocacy side of things. The purpose of this blog is to prepare fans and citizens for what may or may not occur. I think I am well-equipped to wade through much of the b.s. that will likely be thrown around. What I hope will remain are facts. It is up to you, the reader, to make your own judgment based on that information.

Disclaimer over.

Ballpark/Hegenberger Development Plan

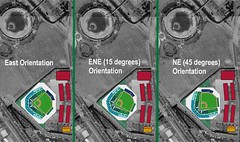

This new pic shows the field at 0 degrees (East), 15 degrees (ENE), and 45 degrees (NE). The blocks on the right depict other development.

The large red block at the top is a "big box" retailer, such as Target. Target or Kohl's would be prime candidates, since both are expanding aggressively, and neither currently serve Oakland. Target even has an unusual situation where two stores in San Leandro are only about a mile apart, making one a potential relocation candidate. (Note: These companies are just examples based on their profiles - they aren't endorsements of a particular store or its products.)

The 4 long blocks are for mixed-use retail/housing. The look would be similar to Santana Row in San Jose or Bay Street in Emeryville - open air shopping "district" with ground floor retail/restaurants and housing above it on 2-5 stories.

The orange/gold block on the bottom is a 300-room high-rise hotel. Hilton, who frequently works with Lewis Wolff, may be looking to move up from the dated Oakland Airport Hilton, and this site would be much more of a destination than the current Hilton is.

Integration with the stadium would be in the form of a large outfield plaza with a gate in center. The concept is similar to what is being planned for the new Busch Stadium. Nominal amounts of surface and/or garage parking would be required.

The advantage of a plan like this is that it completely transforms the streetscape on one side of Hegenberger. New developers could be spurred to develop on the other side. The Pak n Save supermarket across the street could be in line for an upgrade, or it could transform into a more upscale Safeway, who happens to be Pak n Save's parent company.

There are more than a few disadvantages. First is the fact that Hegenberger Gateway presents built-in competition. HG will also be a litmus test for the potential of retail in the Coliseum area. If retail space doesn't get filled up and if impressive sales figures don't come over the next year or two, fewer companies will be interested in placing a presence in East Oakland.

Then there remains the issue of cost. If someone were to want to develop all of it in a short timeframe - say, 3-4 years - the price tag would be enormous. How much? The ballpark costs $280 million. The retail and housing part, maybe $300 million. The hotel, probably $100 million. Garages - another $10 million. So the total cost of this project would come close to $700 million! And that doesn't even count whatever infrastructure improvements would be pledged by the City. (These figures come from published costs of other similar projects.)

Success would be a double-edged sword. Gentrification of the area would lower crime rates, bring better quality services and drive up property values, but it could also drive up rents, forcing lower income residents out of the market. San Francisco's SoMa neighborhood is the most notorious example of this phenomenon.

Going back to funding, one-shot building is probably not the way the project would be approached. Instead, the stadium and perhaps either the big-box retailer or the hotel would act as anchors to attract further privately-funded development.

Oakland City Councilmember Larry Reid has shown interest in spurring development in the Coliseum area via a new ballpark. Reid will have to carry the torch for any ballpark project, regardless of the size. No matter how much Wolff wants to control the process, he will need someone on the inside to go to bat for him. I have a hard time believing that a new ballpark won't require some sizable amount of public funding.

The large red block at the top is a "big box" retailer, such as Target. Target or Kohl's would be prime candidates, since both are expanding aggressively, and neither currently serve Oakland. Target even has an unusual situation where two stores in San Leandro are only about a mile apart, making one a potential relocation candidate. (Note: These companies are just examples based on their profiles - they aren't endorsements of a particular store or its products.)

The 4 long blocks are for mixed-use retail/housing. The look would be similar to Santana Row in San Jose or Bay Street in Emeryville - open air shopping "district" with ground floor retail/restaurants and housing above it on 2-5 stories.

The orange/gold block on the bottom is a 300-room high-rise hotel. Hilton, who frequently works with Lewis Wolff, may be looking to move up from the dated Oakland Airport Hilton, and this site would be much more of a destination than the current Hilton is.

Integration with the stadium would be in the form of a large outfield plaza with a gate in center. The concept is similar to what is being planned for the new Busch Stadium. Nominal amounts of surface and/or garage parking would be required.

The advantage of a plan like this is that it completely transforms the streetscape on one side of Hegenberger. New developers could be spurred to develop on the other side. The Pak n Save supermarket across the street could be in line for an upgrade, or it could transform into a more upscale Safeway, who happens to be Pak n Save's parent company.

There are more than a few disadvantages. First is the fact that Hegenberger Gateway presents built-in competition. HG will also be a litmus test for the potential of retail in the Coliseum area. If retail space doesn't get filled up and if impressive sales figures don't come over the next year or two, fewer companies will be interested in placing a presence in East Oakland.

Then there remains the issue of cost. If someone were to want to develop all of it in a short timeframe - say, 3-4 years - the price tag would be enormous. How much? The ballpark costs $280 million. The retail and housing part, maybe $300 million. The hotel, probably $100 million. Garages - another $10 million. So the total cost of this project would come close to $700 million! And that doesn't even count whatever infrastructure improvements would be pledged by the City. (These figures come from published costs of other similar projects.)

Success would be a double-edged sword. Gentrification of the area would lower crime rates, bring better quality services and drive up property values, but it could also drive up rents, forcing lower income residents out of the market. San Francisco's SoMa neighborhood is the most notorious example of this phenomenon.

Going back to funding, one-shot building is probably not the way the project would be approached. Instead, the stadium and perhaps either the big-box retailer or the hotel would act as anchors to attract further privately-funded development.

Oakland City Councilmember Larry Reid has shown interest in spurring development in the Coliseum area via a new ballpark. Reid will have to carry the torch for any ballpark project, regardless of the size. No matter how much Wolff wants to control the process, he will need someone on the inside to go to bat for him. I have a hard time believing that a new ballpark won't require some sizable amount of public funding.

Subscribe to:

Comments (Atom)