League revenue is up again, this time 9.3% over last season. That's actually down from the last three seasons, when they typically had 14% gains. Revenue is still impressive and will only go up through the end of the current CBA. Yield like that would be an excellent investment for those looking for a mid cap. Of course, MLB is entirely private so no one outside the Lodge could entertain such notions. Regardless, it's impressive.

The A's experienced an 11% jump, from $292 million to $323 million. They continue to ride the revenue sharing gravy train, as local revenue pales in comparison to most of their brethren. The welfare check should only become bigger next season as early attendance figures from the first two weeks portend a low season-end total. Forbes' summary of the A's financial situation is incorrect in that it identifies TIF as a funding mechanism for the ballpark. TIF requires bond money be raised. They're not doing that in Fremont. Instead, privately generated proceeds from the sale of housing rights will help foot the bill.

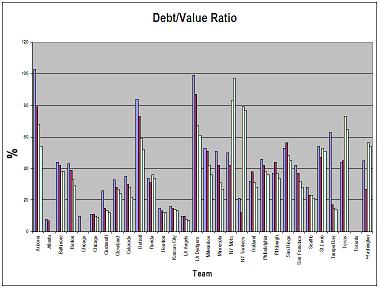

I'm surprised that this year's edition didn't cover the debt issue. Quite possibly, the toughest task for Selig was to whip owners into shape by getting them to spend less. Over the last four years, teams have dropped from a collective 39.7% in debt to 32.7%, and that includes the two new stadia being built for the NY teams.

click for a larger chart

Look at the values on a team-by-team basis, and you'll see a major trend downward for most of them. The old 60-40 debt rule may be obsolete, but it still informs club executives on how to run their teams, just as 50-60% of revenue is comfortable salary "guideline" for the teams.

Nowadays, there's a simplification of the debt rule: teams can't be in hock over 10 times the average EBITDA over the past two seasons. Notice that the A's current valuation is exactly 10 times that of their average operating income from that period? I doubt it's a coincidence. Moreover, the first $36.5 million in debt grandfathered from previous years doesn't count, so if you're Fred Wilpon or Frank McCourt and you borrowed heavily to buy your teams, it's not that bad. And as an incentive to upgrade to new digs, any team incurring stadium debt gets to bump up to 15 times EBITDA for up to 10 years after the facility is complete. The difference between 10 and 15 times doesn't sound like much. It's only $75 million. Since income is expected to rise thanks to the massive payroll drop, so will that debt ceiling. Look for this:

- $30 million in earnings each year in the two years prior to the ballpark opening

- Multiply that figure by 15 to get max debt load, $450 million (which equals the projected ballpark construction cost)

There is, of course, the matter of player salaries. They're the biggest expense and so they factor in. However, that fat $36.5 million deductible comes in handy, especially as a team's payroll drops to approach that figure. Again, the rule is not a hard and fast rule like the NFL's salary cap, with Selig or Bob DuPuy getting all punitive every winter. Referring back to the chart, it appears to be set up so that when teams are forced to go into major debt like the Yanks or Mets, the other fiscally responsible teams help soften the blow. In that sense, MLB and other leagues are akin to conglomerates, with each team acting as a single business unit. When a major profit center (Yanks/Mets) has to invest to invest in a new plant (stadium), the other units tighten up in response. After all, it's the company's overall health, not a business unit's, that gets trumpeted by Selig. As the new plants open and become amortized, others take their turns.

Call it MLB's "Circle of Life."